Q: I’m looking to retire soon and am trying to decide how to produce income from my investments. Interest rates on bonds haven’t been so great lately and a friend suggested investing in dividend-paying stocks, but I’m worried about the risks. Please help.

A: With your retirement coming soon, it’s certainly important to understand your level of risk, considering recent market volatility. And while many people turn to bonds for perceived safety and income, dividend-paying stocks may serve as a good compliment to bonds for income.

It used to be that investors seeking steady income turned exclusively to bonds, whose regular interest payments provided a dependable income source, especially for retirees. But times have changed. With many retirements today lasting 30 years or more, income investors need to make sure their savings keep pace with inflation and last a long time. This means investing in assets that provide current income, yet have the potential to grow in value and yield over time.

One widely used strategy is to include dividend-paying stocks in your portfolio. History provides compelling evidence of the long-term benefits of dividends and their reinvestment:

• Dividends are a sign of corporate financial health. Dividend payouts are often seen as a sign of a company’s financial health and management’s confidence in future cash flow. Dividends also communicate a positive message to investors who perceive a long-term dividend as a sign of corporate maturity and strength.

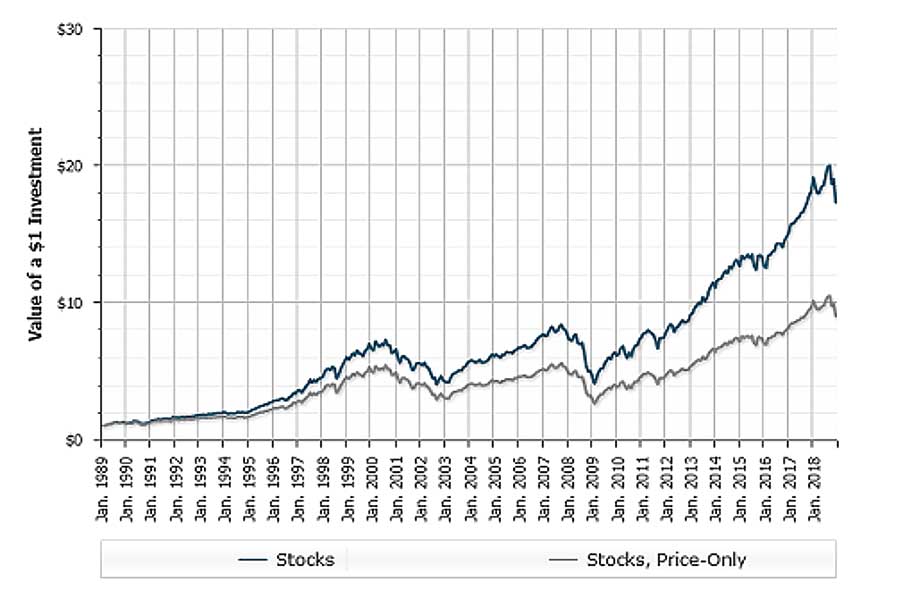

• Dividends are a key driver of total return. Several factors may contribute to the superior total return of dividend-paying stocks over the long term. One of them is dividend reinvestment. The longer the period during which dividends are reinvested, the greater the spread between price return and dividend reinvested total return.

• Dividend payers offer potentially stronger returns, lower volatility. Dividends may help to mitigate portfolio losses when stock prices decline, and over long time horizons, stocks with a history of increasing their dividend each year have also produced higher returns with less risk than non-dividend-paying stocks. For instance, for the 10 years ended June 30, 2019, the S&P 500 Dividend Aristocrats — those stocks within the S&P 500 that have increased their dividends each year for the past 25 years — produced average annualized returns of 16.3 percent vs. 14.7 percent for the S&P 500 overall, with less volatility (11.7 percent vs. 12.7 percent, respectively).1

• Dividends benefit from potentially favorable tax treatment. Most taxpayers are subject to a top federal tax rate of only 15 percent on qualified dividends, although certain high-income taxpayers may pay up to 23.8 percent. However, that is still lower than the current 37 percent top rate on ordinary income.

• Dividend-paying stocks may help diversify an income-generating portfolio. Income-oriented investors may want to diversify potential sources of income within their portfolios.

Stocks with above-average dividend yields may compare favorably with bonds and may act as a buffer should conditions turn negative within the bond market.

If you are considering adding dividend-paying stocks to your investment mix, keep in mind that they generally carry higher risk than bonds. Stock investing involves the potential for loss of principal. Also, dividends can be increased, decreased and/or eliminated at any time without prior notice. That’s why it’s important to choose your dividend-paying stocks carefully, since some companies may increase dividends to attract investors if their finances aren’t watertight or their outlook is cloudy.

Your financial professional can help you determine if dividend-paying stocks are a good fit for your portfolio.

Jeremy R. Gussick is a CERTIFIED FINANCIAL PLANNER™ professional affiliated with LPL Financial, the nation’s largest independent broker-dealer.* Jeremy specializes in the financial planning and retirement income needs of the LGBT community and was recently named a 2018 FIVE STAR Wealth Manager as mentioned in Philadelphia Magazine.** He is active with several LGBT organizations in the Philadelphia region, including DVLF (Delaware Valley Legacy Fund) and the Independence Business Alliance (IBA), the Philadelphia Region’s LGBT Chamber of Commerce. OutMoney appears monthly. If you have a question for Jeremy, you can contact him via email at jeremy.gussick@lpl.com.

Jeremy R. Gussick is a Registered Representative with, and securities and advisory services are offered through LPL Financial, a Registered Investment Advisor, Member FINRA/SIPC.

1Source: DST Systems, Inc., based on data from Standard & Poor’s. Volatility is measured by standard deviation. Standard deviation is a historical measure of the variability of returns relative to the average annual return. If a portfolio has a high standard deviation, its returns have been volatile. A low standard deviation indicates returns have been less volatile. Past performance is no guarantee of future results.

2Source: It is not possible to invest directly in an index. Index performance does not reflect the effects of investing costs and taxes. Actual results would vary from benchmarks and would likely have been lower. Past performance is not a guarantee of future results

This article was prepared with the assistance of DST Systems Inc. The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. This communication is not intended to be tax advice and should not be treated as such. We suggest that you discuss your specific situation with a qualified tax or legal advisor. Please consult me if you have any questions. To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL Financial LLC is not an affiliate of and makes no representation with respect to such entity.

Because of the possibility of human or mechanical error by DST Systems Inc. or its sources, neither Wealth Management Systems Inc. nor its sources guarantees the accuracy, adequacy, completeness or availability of any information and is not responsible for any errors or omissions or for the results obtained from the use of such information. In no event shall DST Systems Inc. be liable for any indirect, special or consequential damages in connection with subscribers’ or others’ use of the content.

© 2019 DST Systems, Inc. Reproduction in whole or in part prohibited, except by permission. All rights reserved.

*As reported by Financial Planning magazine, June 1996-2019, based on total revenues.

**Award based on 10 objective criteria associated with providing quality services to clients such as credentials, experience, and assets under management among other factors. Wealth managers do not pay a fee to be considered or placed on the final list of Five Star Wealth Managers.