Q: My spouse and I are considering buying our first home and we understand that our credit history and credit score can factor into the terms of our mortgage. Where can we start to learn more about our scores and how to make them better if needed?

A: First, congratulations on your potential home purchase. You are correct: Being aware of, and properly managing your credit score, is important throughout your life, especially when you’re looking to finance a purchase. Here’s what you need to know to get started:

Whether you are applying for a credit card, car loan or mortgage, your credit score is critical in determining if you can get the credit, how much you can get and what you’ll pay for it.

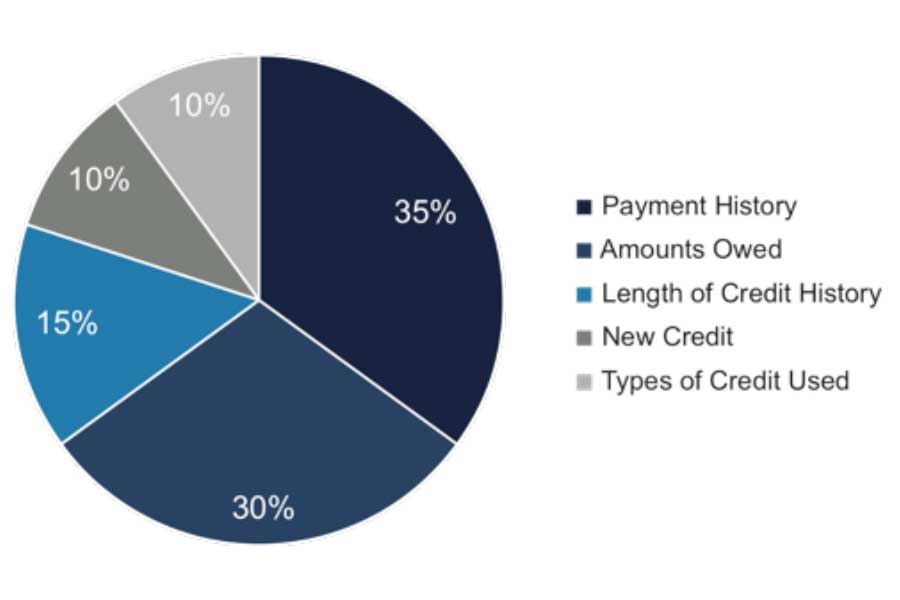

The most widely used credit scores are FICO® Scores, those generated by the Fair Isaac Corporation. In fact, more than 90 percent of top lenders use FICO® Scores to help them make consumer-credit decisions.1 FICO® Scores are calculated based on information supplied by the three major credit reporting agencies: Equifax, Experian, and TransUnion, which generate scores using a proprietary formula that assigns weightings to the five main factors illustrated below:

Weighting the factors in your score

Payment history: Timely payments are an important component of your credit score. Using your credit responsibly and paying bills on time are great ways to maintain a good credit score.

Amounts owed: This factor reflects the percentage of your available credit that you are using. High credit utilization can be a warning sign of credit risk.

Length of credit history: Your credit history is a significant contributor to your credit score. Accordingly, the average age of your credit accounts can be a strong indication of your credit history. Care should be used in keeping old accounts open and in good standing.

New credit: While opening one new credit card might be normal, opening several in a short span of time could be a warning sign to potential creditors that something is amiss in your financial life.

Types of credit used: Both the total number of credit accounts you have and the mix of credit you have will affect your credit score. A healthy mix of revolving credit cards, charge cards, installment loans and mortgages will also impact your credit score.

What is a ‘good’ credit score?

A typical credit score will range 300-850 points. Generally speaking, the higher the score, the lower the risk, and the better the pricing you may be offered. The differences can be significant.

For instance, at current rates, a borrower with a credit score of between 760 and 850 might expect to pay a rate of 4.162 percent on a 30-year, $300,000 fixed-rate mortgage, according to myFICO.com’s Loan Savings Calculator. By contrast, an individual with a score of 620-639 might expect a rate of 5.731 percent, which amounts to an extra $287 monthly payment and about $103,200 more in total interest paid over the life of the mortgage.2

Keep in mind, however, that lenders differ and there are many additional factors that they may use to determine your actual interest rates.

Tracking your score

U.S. consumers are entitled to a free credit report each year from all three credit reporting agencies mentioned above. You can request your reports at www.AnnualCreditReport.com.

Unlike credit reports, however, your credit score is not free. You can purchase your score from one of the agencies or from myFICO.com.

Improving your score

Here are some time-proven tips for raising a credit score and maintaining it once it improves:

• Pay your accounts on time and keep your balances low. Lenders typically look for a proven track record of making timely payments.

• Be conservative in the amount of available credit you use at any given time. Your “utilization ratio” is the amount you owe in relation to the amount of credit available to you. Try to keep that ratio below 30 percent.

• Hold on to older, unused accounts. The longer an account has been open and managed successfully, the higher your score will be.

• Maintain a diversified credit mix. If you hold an auto loan, a home mortgage and credit cards that are well managed, you will generally have a higher credit score than someone whose credit consists mainly of loans from finance companies.

1Source: myFICO.com, retrieved July 2018.

2Source: myFICO.com, Loan Savings Calculator, July 16, 2018. Rates are averages based on thousands of financial lenders, conducted daily by Informa Research Services, Inc.

Jeremy R. Gussick is a CERTIFIED FINANCIAL PLANNER™ professional affiliated with LPL Financial, the nation’s largest independent broker-dealer.* Jeremy specializes in the financial planning and retirement income needs of the LGBT community and was recently named a 2018 FIVE STAR Wealth Manager as mentioned in Philadelphia Magazine.** He is active with several LGBT organizations in the Philadelphia region, including DVLF (Delaware Valley Legacy Fund) and the Independence Business Alliance (IBA), the Philadelphia Region’s LGBT Chamber of Commerce. OutMoney appears monthly. If you have a question for Jeremy, you can contact him via email at jeremy.gussick@lpl.com.

Jeremy R. Gussick is a Registered Representative with, and securities and advisory services are offered through LPL Financial, a Registered Investment Advisor, Member FINRA/SIPC.

This article was prepared with the assistance of DST Systems Inc. The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. We suggest that you discuss your specific situation with a qualified tax or legal advisor. Please consult me if you have any questions. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. All investing involves risk including loss of principal. No strategy assures success or protects against loss.

LPL Financial Representatives offer access to Trust Services through The Private Trust Company N.A., an affiliate of LPL Financial.

Because of the possibility of human or mechanical error by DST Systems Inc. or its sources, neither Wealth Management Systems Inc. nor its sources guarantees the accuracy, adequacy, completeness or availability of any information and is not responsible for any errors or omissions or for the results obtained from the use of such information. In no event shall DST Systems Inc. be liable for any indirect, special or consequential damages in connection with subscribers’ or others’ use of the content.

To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL Financial LLC is not an affiliate of and makes no representation with respect to such entity.

*As reported by Financial Planning magazine, June 1996-2017, based on total revenues.

**Award based on 10 objective criteria associated with providing quality services to clients such as credentials, experience, and assets under management among other factors. Wealth managers do not pay a fee to be considered or placed on the final list of 2017 Five Star Wealth Managers.